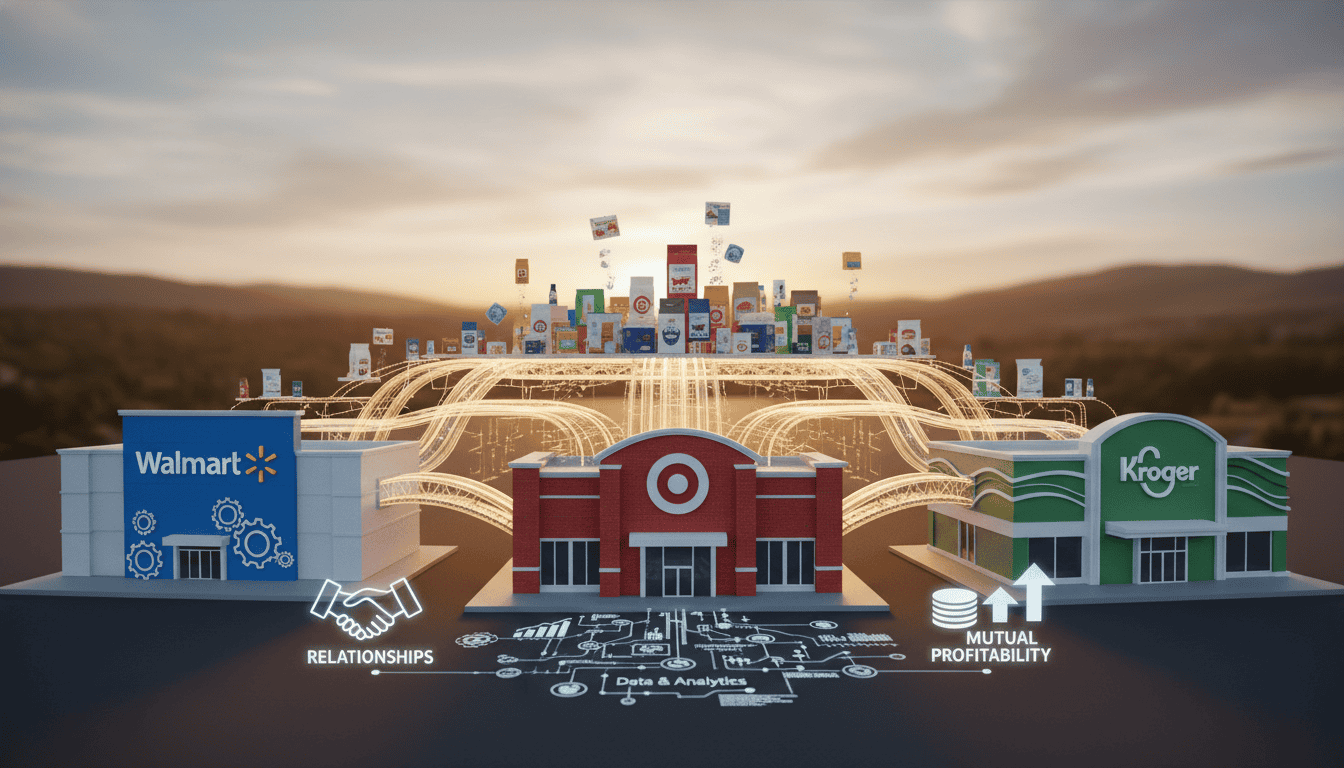

Major retail chains control over 60% of CPG sales volume, yet most emerging brands approach these partnerships with outdated strategies that guarantee rejection. The difference between brands that secure premium shelf space and those relegated to online-only sales often comes down to understanding what major retailers actually want from their CPG partners.

Understanding the Retail Partnership Landscape

The consumer packaged goods (CPG) industry operates on relationships, data, and mutual profitability. When you’re approaching major chains like Walmart, Target, or Kroger, you’re not just selling a product—you’re proposing a business partnership that needs to benefit both parties significantly.

Here’s what most brands get wrong: they focus on their product features instead of the retailer’s bottom line. Major chains evaluate potential partners based on three core criteria: sales velocity potential, margin contribution, and operational efficiency. Your pitch needs to address all three from day one.

The Buyer’s Perspective

Retail buyers review hundreds of product presentations monthly. They’re looking for brands that understand their specific challenges:

- Inventory turnover rates and shelf space optimization

- Consumer demand data and market trends

- Supply chain reliability and scalability

- Marketing support and promotional partnerships

- Compliance with retailer-specific requirements

Most successful CPG partnerships start with brands demonstrating they’ve done their homework on the retailer’s customer base, store formats, and strategic priorities.

Building Your Foundation for Major Chain Partnerships

Market Data and Consumer Insights

Before approaching any major retailer, you need rock-solid market data. This isn’t just about your product’s performance—you need to understand the category dynamics within that specific retailer’s ecosystem.

Start by analyzing syndicated data from Nielsen or IRI if you have access. If not, use tools like Google Trends, social listening platforms, and consumer surveys to build a compelling story about market demand. The key is showing buyers that your product fills a specific gap in their current assortment.

Here’s a practical approach: Visit multiple locations of your target retailer and conduct informal consumer interviews. Ask shoppers what they’re looking for that they can’t find. Document these insights and include them in your partnership proposal.

Operational Readiness

Major chains don’t partner with brands that can’t scale. You need to demonstrate operational readiness across several areas:

Supply Chain Capacity: Can you handle a sudden 300% increase in orders? Do you have backup suppliers? Most retailers will stress-test your supply chain projections during negotiations.

Technology Integration: Each major retailer has specific EDI requirements, data sharing protocols, and inventory management systems. Getting these wrong delays launch by months.

Quality Assurance: Your quality control processes need to meet or exceed retailer standards. This includes everything from product consistency to packaging integrity during shipping.

The Partnership Development Process

Research and Target Selection

Not all major chains are right for your brand, and approaching the wrong ones first can hurt your chances with better-fit retailers later. Here’s how to prioritize:

Customer Alignment: Does your target customer shop at this retailer? This seems obvious, but many brands chase prestigious partnerships instead of profitable ones. A health-focused snack might perform better at Whole Foods than Walmart, despite Walmart’s larger scale.

Category Performance: Research how your product category performs at different retailers. Some chains excel in specific categories while struggling in others. Use this intelligence to identify retailers where your category is growing.

Competitive Analysis: Look at where similar successful brands launched first. Often, there’s a logical progression from specialty retailers to mainstream chains that you can follow.

Initial Outreach Strategy

Cold emails to category buyers rarely work. Here are more effective approaches:

Industry Trade Shows: Events like Natural Products Expo, Fancy Food Show, or retailer-specific vendor days provide face-to-face opportunities with decision makers.

Broker Relationships: Experienced food brokers have established relationships with retail buyers and understand each chain’s preferences and processes. The right broker relationship can be worth their commission fee.

Referral Networks: Other CPG brands, industry consultants, and even satisfied retailers can provide warm introductions to new accounts.

Negotiating Partnership Terms

Understanding Retailer Economics

Successful negotiations start with understanding what drives profitability for your retail partner. Most major chains evaluate CPG partnerships on several financial metrics:

Gross Margin Percentage: The difference between what they pay you and their retail price. Different categories have different margin expectations.

Sales Per Linear Foot: How much revenue your product generates per inch of shelf space compared to alternatives.

Inventory Turns: How quickly your product sells through, affecting their working capital requirements.

Come to negotiations with proposals that improve these metrics for the retailer, not just your own profitability.

Common Partnership Terms

Every major retailer has standard terms, but there’s usually room for negotiation based on your brand’s strength and category dynamics:

Slotting Fees: Upfront payments for shelf space. These vary dramatically by retailer and category. Sometimes you can negotiate performance-based alternatives.

Promotional Requirements: Most chains expect regular promotional support. Budget for this from day one, as promotional performance often determines long-term success.

Payment Terms: Payment schedules can significantly impact your cash flow. Negotiate these carefully, especially for new brands with limited working capital.

Maintaining and Growing Retail Relationships

Performance Monitoring and Reporting

Landing the partnership is just the beginning. Long-term success requires active relationship management and performance optimization.

Most major retailers provide detailed sales data through vendor portals. Use this data proactively:

- Identify underperforming stores and develop action plans

- Track promotional lift and ROI for different marketing activities

- Monitor inventory levels to prevent stockouts or overstock situations

- Benchmark your performance against category averages

Schedule regular business reviews with your buyers. Come prepared with performance data, market insights, and growth proposals. Buyers appreciate partners who bring strategic thinking, not just order fulfillment.

Innovation and Line Extensions

Major retailers reward successful partners with opportunities for line extensions and new product launches. The key is timing these discussions around strong performance data.

When proposing new products, focus on how they’ll drive incremental sales rather than cannibalizing existing products—a core principle of effective category management that retailers value highly. Retailers want partners who grow the overall category, not just shift sales between SKUs.

Common Pitfalls and How to Avoid Them

Operational Missteps

The most common reason CPG partnerships fail isn’t poor sales—it’s operational problems that damage retailer confidence.

Stockouts: Running out of inventory damages your relationship more than poor sales performance. Build buffer inventory and backup supply plans.

Quality Issues: Product recalls or quality complaints can end partnerships immediately. Invest in quality control systems that exceed retailer requirements.

Communication Failures: Retailers need predictable communication. Set up regular update schedules and stick to them, even when there’s no news to share.

Financial Overextension

Many brands underestimate the financial requirements of major retail partnerships. Between slotting fees, promotional requirements, and working capital needs, partnering with major chains can strain cash flow.

Plan for 18-24 months of runway after launch. Sales often start slowly while you optimize pricing, promotions, and consumer awareness. Brands that run out of capital during this ramp-up period lose their partnerships and shelf space.

Digital Integration and Omnichannel Strategy

Modern retail partnerships extend beyond physical shelf space. Major chains increasingly expect CPG partners to support their digital initiatives:

E-commerce Optimization: Your products need to perform well on retailer websites, requiring different imagery, descriptions, and promotional strategies than in-store sales.

Social Media Collaboration: Many retailers co-promote successful CPG partners through their social channels. Have content and campaign ideas ready to propose.

Data Sharing: Progressive retailers share customer insights with key partners. Use this data to refine your product development and marketing strategies.

Measuring Partnership Success

Success in CPG retail partnerships goes beyond sales volume. Track these key performance indicators:

- Velocity: Sales per store per week, compared to category averages

- Distribution growth: Expansion to new stores or regions within the chain

- Promotional performance: Lift during promotional periods and sustained sales afterward

- Profitability: Net profit after all retailer fees and promotional costs

- Relationship health: Buyer satisfaction and willingness to consider new products

The most successful CPG brands view retail partnerships as long-term strategic relationships, not transactional sales channels. This perspective influences every decision from pricing to product development to marketing support.

Conclusion

Building successful partnerships with major retail chains requires a complete understanding of retailer priorities, operational excellence, and long-term relationship management. The brands that succeed approach these partnerships as strategic alliances, not just distribution channels.

Success in CPG retail partnerships comes down to preparation, performance, and persistence. The investment in doing it right pays dividends in sustainable revenue growth and market expansion opportunities.

At Beast Creative Agency, we help CPG brands develop the data-driven marketing strategies that retail buyers demand. Our team understands both the creative elements that drive consumer demand and the analytical approach that builds retailer confidence. Ready to build partnerships that drive real growth? Let’s discuss how our experience in CPG marketing can support your retail expansion goals.