Raw material costs for consumer packaged goods jumped 23% in the past year alone, turning profit margins into moving targets for even the most established brands. While commodity price swings have always existed, today’s volatility reaches unprecedented levels, demanding sophisticated strategies that go far beyond traditional cost management approaches.

Understanding the New Reality of Commodity Price Volatility

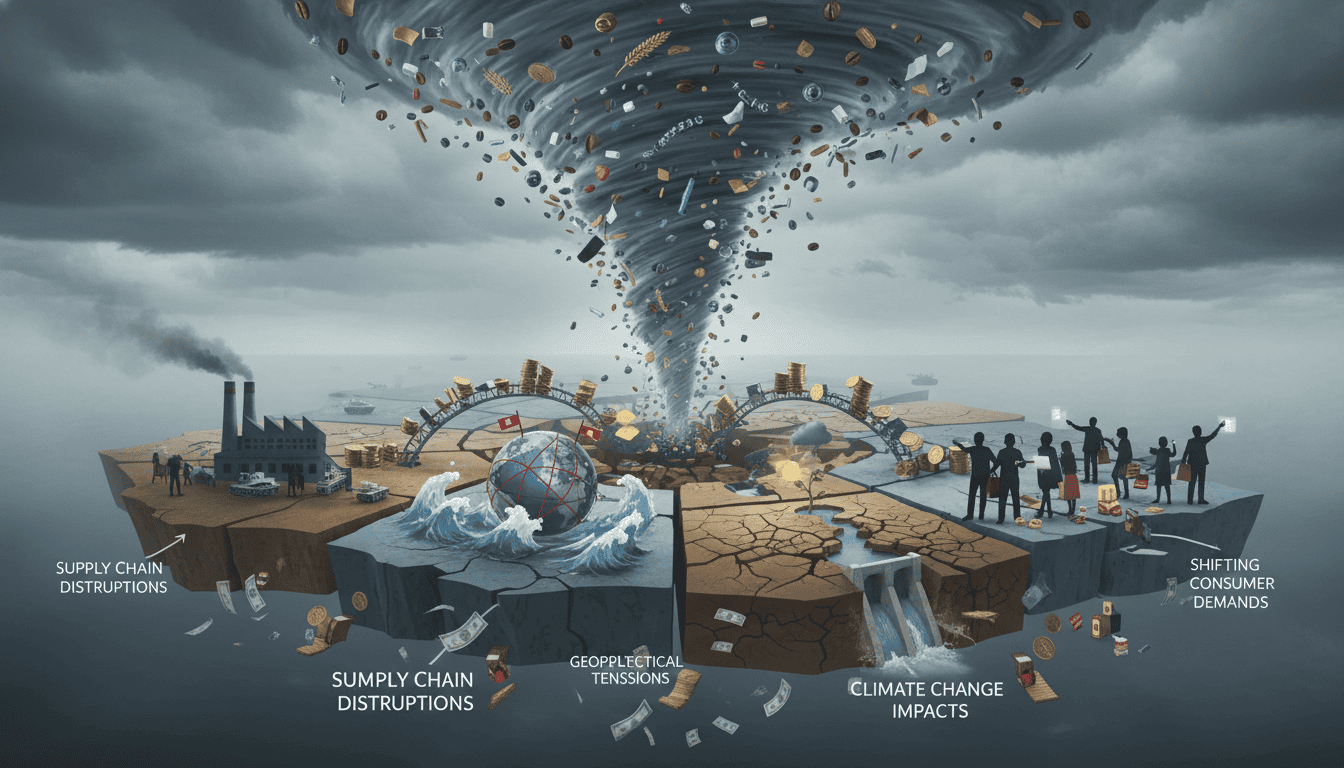

The CPG industry faces a perfect storm of factors driving input cost fluctuations. Supply chain disruptions, geopolitical tensions, climate change impacts, and shifting consumer demands create a landscape where wheat prices can spike 40% in three months, or aluminum costs can double seemingly overnight.

Here’s what makes today’s volatility different: it’s not just about one commodity anymore. CPG companies now deal with synchronized price movements across multiple raw materials, from packaging materials to active ingredients. This interconnected volatility means traditional hedging strategies often fall short.

The Ripple Effect on Brand Strategy

Smart CPG leaders recognize that commodity price management isn’t just a procurement issue—it’s a marketing challenge. When input costs fluctuate dramatically, brands face tough decisions about pricing, positioning, and product formulation that directly impact consumer perception and market share.

Most businesses miss this connection between commodity management and brand equity. They treat cost fluctuations as purely financial problems, missing opportunities to strengthen customer relationships through transparent communication and innovative solutions.

Strategic Approaches to Input Cost Management

Dynamic Pricing Models

The days of set-and-forget pricing are over. Forward-thinking CPG companies now use dynamic pricing models that adjust based on input cost changes while maintaining competitive positioning. This approach requires:

- Real-time cost tracking systems that monitor commodity prices across all inputs

- Automated pricing algorithms that factor in competitor responses and market conditions

- Clear communication strategies that explain price changes to retail partners and consumers

- Buffer zones that prevent constant price fluctuations from disrupting market relationships

The key is building flexibility without appearing unstable. Successful brands establish pricing corridors that allow for adjustments while maintaining predictability for their retail partners.

Portfolio Diversification Strategies

Smart CPG companies don’t just diversify their product lines—they diversify their commodity exposure. This means:

Geographic Sourcing Spread: Working with suppliers across different regions reduces exposure to localized price shocks. When drought affects one region, alternative sources can maintain supply stability.

Commodity Substitution Planning: Developing formulations that can switch between similar raw materials gives companies flexibility when prices spike. For example, food manufacturers might alternate between different oils or sweeteners based on cost efficiency.

Vertical Integration Opportunities: Some companies find value in controlling critical parts of their supply chain, especially for unique or high-impact ingredients.

Financial Hedging and Risk Management

Modern commodity hedging goes beyond basic futures contracts. Sophisticated CPG companies use:

- Options strategies that provide price protection while maintaining upside potential

- Commodity swaps that exchange variable costs for fixed payments

- Weather derivatives for companies affected by climate-sensitive raw materials

- Currency hedging to manage foreign exchange impacts on imported commodities

The reality is that no single hedging strategy works for every situation. The most effective approach combines multiple tools based on specific risk tolerance and business objectives.

Operational Excellence in Volatile Markets

Demand Forecasting Integration

Here’s what works: connecting commodity price forecasts with demand planning. When raw material costs are expected to rise, companies can adjust production schedules to build inventory at lower costs. When prices are falling, they can reduce inventory to avoid carrying high-cost materials.

This integration requires sophisticated planning systems that can model multiple scenarios and adjust quickly as conditions change. The payoff comes in the form of improved margins and reduced waste.

Supplier Relationship Management

Long-term supplier partnerships become even more valuable during volatile periods. Strong relationships provide:

- Early warning systems about upcoming price changes

- Collaborative problem-solving when supply issues arise

- Preferential treatment during shortage periods

- Joint innovation opportunities to reduce commodity dependence

The best CPG companies treat their key suppliers as strategic partners, sharing forecasts and market intelligence to mutual benefit.

Innovation as a Volatility Buffer

Reformulation Strategies

Product innovation becomes a powerful tool for managing input costs. This might surprise you, but some of the most successful cost management strategies come from R&D departments, not procurement teams.

Effective reformulation strategies include:

- Developing recipes that use lower-cost alternatives without compromising quality

- Creating concentrated formulas that reduce packaging and shipping costs

- Engineering products that use more stable, less volatile commodities

- Building flexibility into formulations to allow ingredient substitution

Packaging Innovation

Packaging represents a significant portion of CPG costs and offers substantial opportunities for volatility management. Smart companies explore:

Material Optimization: Using less material through improved design or concentrating products to require smaller packages.

Alternative Materials: Developing packaging solutions that use different raw materials, especially renewable or recycled options that may have more stable pricing.

Multi-Use Designs: Creating packaging that serves multiple functions or can be easily recycled, adding consumer value while managing costs.

Technology Solutions for Cost Management

Predictive Analytics

Advanced analytics help CPG companies anticipate commodity price movements and adjust strategies accordingly. Modern systems can analyze weather patterns, political developments, economic indicators, and historical trends to provide early warnings about potential price volatility.

These tools work best when integrated with existing ERP systems, providing real-time insights that inform procurement, production, and pricing decisions.

Automation and Efficiency

When raw material costs rise, operational efficiency becomes even more important. Automated systems can help reduce waste, optimize production schedules, and minimize handling costs that compound commodity price impacts.

Smart manufacturing systems can adjust production parameters in real-time to maximize yield and minimize waste, providing crucial margin protection during cost spikes.

Communication and Brand Protection

Here’s the thing about commodity volatility: how you communicate about it matters as much as how you manage it operationally. Successful CPG companies develop clear communication strategies that:

- Explain price changes in terms customers understand

- Emphasize value delivered rather than just cost increases

- Provide alternatives or solutions that help customers manage their own budgets

- Maintain transparency about market conditions affecting the industry

The goal is maintaining trust and loyalty even when prices must increase due to input cost pressures.

Building Organizational Resilience

Managing commodity volatility requires organizational capabilities that extend beyond traditional procurement functions. Companies need:

Cross-Functional Teams: Bringing together procurement, finance, marketing, and operations to make integrated decisions about cost management strategies.

Scenario Planning: Developing contingency plans for different volatility scenarios, from mild fluctuations to severe market disruptions.

Cultural Adaptability: Building organizational comfort with change and uncertainty, so teams can pivot quickly when market conditions shift.

Measuring Success in Volatile Markets

Traditional cost management metrics may not tell the full story during volatile periods. Smart companies track:

- Margin stability over time, not just absolute margin levels

- Market share maintenance during price adjustment periods

- Customer satisfaction scores during cost management initiatives

- Supply chain reliability metrics, not just cost efficiency

- Innovation pipeline strength for cost reduction opportunities

The most important metric might be organizational learning: how quickly the company adapts to new volatility patterns and applies lessons from previous disruptions.

Conclusion

Commodity price volatility isn’t going away—if anything, it’s becoming the new normal for CPG companies. The winners will be those who build systematic approaches to managing input cost fluctuations while maintaining strong brands and customer relationships.

Success requires more than just financial hedging or supplier negotiations. It demands integrated strategies that span operations, innovation, marketing, and organizational development. Companies that master this integration don’t just survive volatile markets—they use volatility as a competitive advantage.

At Beast Creative Agency, we help CPG brands navigate these complex challenges through AI-enhanced campaigns and data-driven strategies that maintain brand strength even during turbulent cost environments. Our personalized approach ensures your marketing investments continue delivering strong ROI, regardless of commodity market conditions.