Nearly 90% of consumer packaged goods startups exhaust their initial capital within the first two years, yet the survivors who master funding diversification grow 3x faster than single-source funded competitors. The difference lies in understanding which funding option matches each growth stage.

Understanding CPG Funding Fundamentals

Consumer packaged goods companies face unique funding challenges that separate them from typical tech startups or service businesses. You’re dealing with inventory costs, manufacturing requirements, retail relationships, and complex supply chains that demand substantial upfront capital.

Here’s the thing: most CPG entrepreneurs approach funding backwards. They chase the biggest check instead of matching funding sources to their specific business stage and needs. This misalignment kills more promising brands than poor product-market fit.

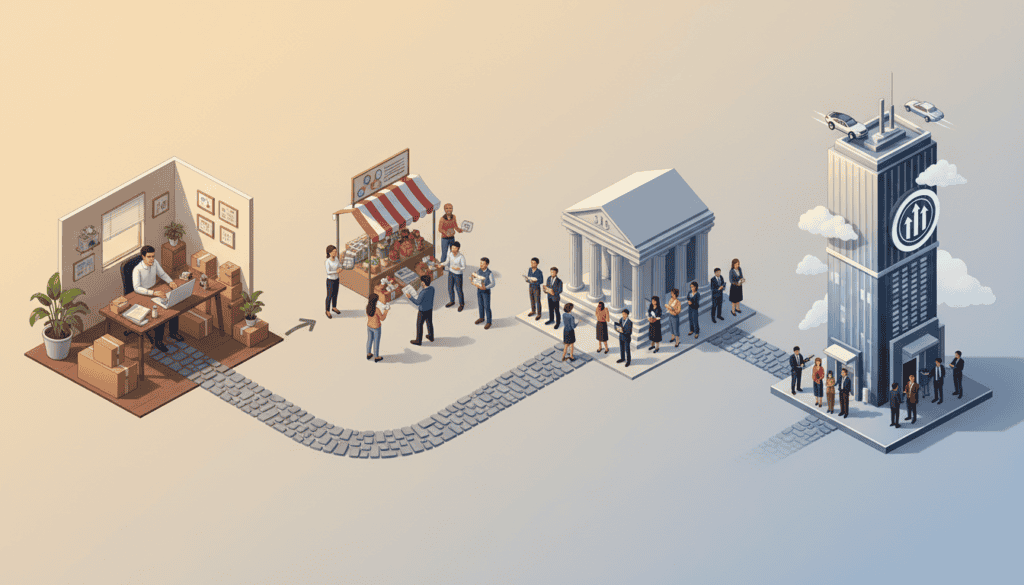

The most successful CPG companies build what we call a “funding ladder” – strategically moving from one funding source to the next as they hit specific milestones and growth requirements.

Bootstrapping: Building Your Foundation

Bootstrapping remains the most common starting point for CPG brands, and for good reason. You maintain complete control, validate real market demand, and build sustainable unit economics before bringing in outside capital.

When Bootstrapping Works Best

Self-funding makes sense when you’re testing product concepts, building initial prototypes, or serving local markets. Many successful CPG brands started in founders’ kitchens or garages, perfecting recipes and building loyal customer bases through farmers markets and direct sales.

The reality is bootstrapping forces discipline. You can’t afford vanity metrics or elaborate marketing campaigns – every dollar must generate measurable returns. This constraint often leads to more creative, cost-effective solutions that become competitive advantages later.

Bootstrapping Strategies That Work

- Pre-sales and crowdfunding: Test demand while generating initial working capital

- Revenue-based growth: Reinvest profits systematically rather than extracting cash

- Lean manufacturing: Start with co-packers instead of building facilities

- Direct-to-consumer focus: Build margins and customer relationships before retail

- Barter and partnerships: Exchange equity or services for needed resources

Most businesses miss this: successful bootstrapping isn’t about being cheap – it’s about being strategic with limited resources. Focus on high-impact activities that directly drive sales and customer acquisition.

Friends and Family Funding

Friends and family rounds typically range from $10,000 to $100,000 and serve as a bridge between bootstrapping and formal investment. This funding works best when you’ve proven initial traction but need capital to scale production or enter new markets.

Structuring Friends and Family Deals

Keep these arrangements professional despite personal relationships. Use simple agreements like convertible notes or SAFE (Simple Agreement for Future Equity) instruments that convert to equity in later funding rounds.

Here’s what works: be transparent about risks, provide regular updates, and set clear expectations about timeline to liquidity. Treat family investors like professional investors – they deserve the same level of communication and respect.

Angel Investors and Seed Funding

Angel investors typically invest $25,000 to $100,000, while seed rounds can reach $500,000 to $2 million. These investors often bring industry expertise, connections, and mentorship beyond just capital.

Finding the Right Angels

Look for angels with CPG experience who understand your specific challenges. Former retail executives, successful CPG founders, and industry veterans make ideal angel investors because they can open doors that pure financial investors cannot.

This might surprise you: many of the best CPG angels don’t actively market themselves. They’re found through industry events, accelerator programs, and warm introductions from other entrepreneurs or advisors.

What Angels Look For

Angel investors evaluate CPG companies differently than tech startups. They focus on:

- Unit economics: Clear path to profitability at the product level

- Market size: Addressable market large enough for significant returns

- Founder-market fit: Deep understanding of the category and customers

- Retail relationships: Existing or clear path to retail distribution

- Brand differentiation: Sustainable competitive advantages

Venture Capital for CPG Companies

Venture capital represents the most substantial funding option, with rounds ranging from $1 million to $50 million or more. However, VC funding comes with significant trade-offs in terms of control, growth expectations, and exit requirements.

CPG-Focused VC Firms

Not all VCs understand consumer packaged goods. Look for firms with dedicated CPG practices or successful CPG investments in their portfolios. These firms understand longer product development cycles, inventory requirements, and retail relationship complexities.

Top CPG-focused VCs include firms like Foundry Group, CircleUp, and Powerplant Ventures, though many traditional VCs have added CPG expertise as the sector has grown.

VC Expectations and Requirements

Venture capitalists typically expect 10x returns on their investments, which means your company needs the potential to reach $100 million+ in revenue. They also expect rapid growth – often 100%+ year-over-year revenue increases.

Here’s the reality: VC funding accelerates everything. You’ll need to scale operations, hire quickly, and expand distribution aggressively. Make sure your systems, team, and market opportunity can handle this acceleration before taking VC money.

Alternative Funding Sources

Beyond traditional equity funding, CPG companies have access to several alternative financing options that can be more suitable for certain situations.

Revenue-Based Financing

Revenue-based financing provides capital in exchange for a percentage of future revenue until a predetermined multiple is repaid. This option works well for profitable companies that need working capital but don’t want to give up equity.

Companies like Clearco and Lighter Capital specialize in revenue-based financing for consumer brands, typically offering $10,000 to $10 million based on historical revenue and growth metrics.

Inventory and Purchase Order Financing

Many CPG companies struggle with the cash flow gap between receiving purchase orders and getting paid by retailers. Inventory financing and purchase order financing help bridge this gap.

These financing options are secured by inventory or specific purchase orders, making them less risky for lenders and more accessible for companies without perfect credit profiles.

Grants and Competitions

Don’t overlook grants and business competitions, especially for companies with social impact components, sustainability focus, or innovative technologies. These non-dilutive funding sources can provide substantial capital without giving up equity.

The USDA, state economic development agencies, and private foundations offer various grant programs for food and consumer product companies.

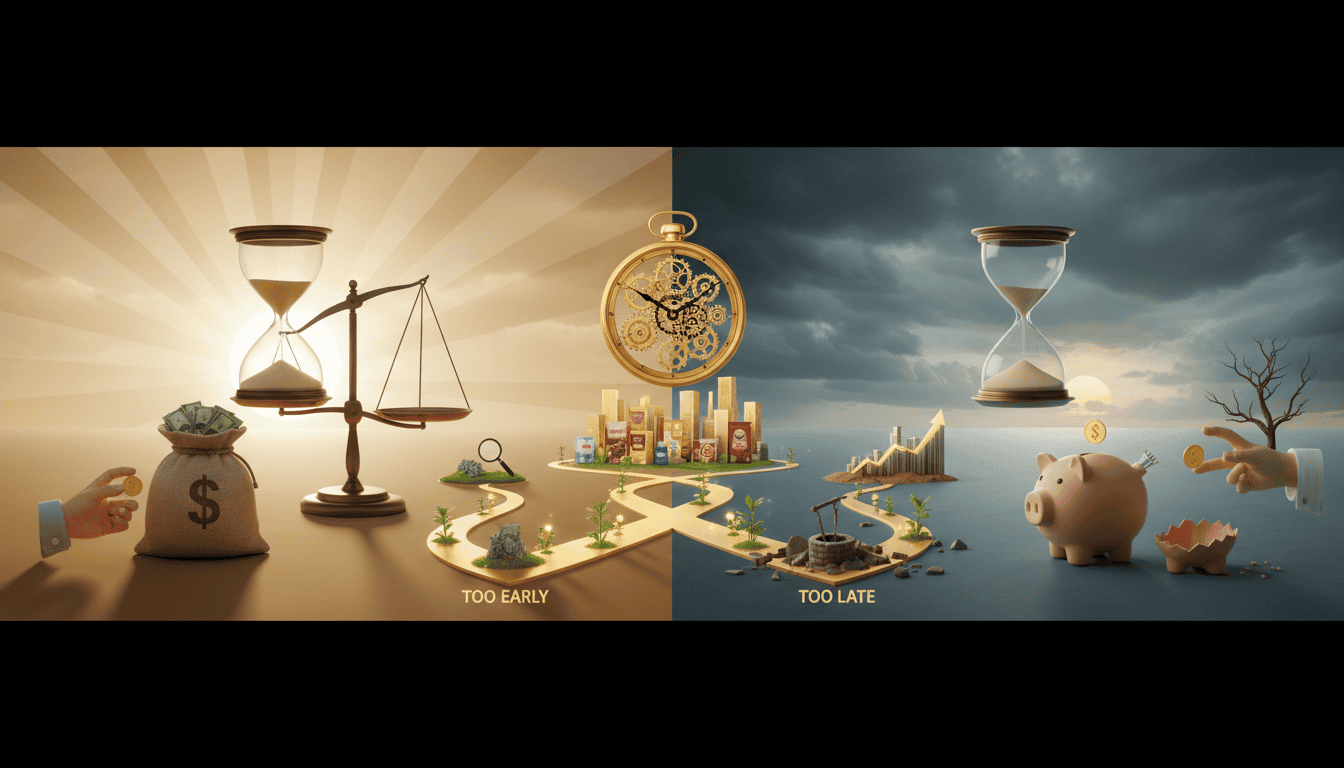

Timing Your Funding Strategy

Successful CPG funding requires careful timing. Raising too early limits your negotiating power, while waiting too long can leave you cash-strapped and unable to capitalize on opportunities.

Key Funding Milestones

Most CPG companies follow a predictable funding progression:

- Pre-revenue: Bootstrapping and friends/family ($0-$50K)

- Initial traction: Angel investment ($50K-$500K)

- Proven demand: Seed funding ($500K-$2M)

- Scale preparation: Series A ($2M-$10M)

- Growth acceleration: Series B and beyond ($10M+)

Here’s what works: raise funding 6-12 months before you actually need it. Fundraising takes longer than expected, and you want to negotiate from a position of strength rather than desperation.

Due Diligence and Investor Relations

Professional investors will conduct thorough due diligence on your company, examining everything from financial projections to supply chain relationships. Preparation is essential for successful fundraising.

Essential Documentation

Prepare a complete data room including:

- Financial statements and projections

- Customer contracts and retail agreements

- Intellectual property documentation

- Manufacturing and supply chain details

- Regulatory compliance records

- Marketing performance metrics

Most businesses miss this: investors care as much about your operational capabilities as your growth metrics. Be prepared to explain how you’ll scale manufacturing, maintain quality, and manage inventory as you grow.

Common Funding Mistakes to Avoid

CPG entrepreneurs often make predictable funding mistakes that limit their options and growth potential.

Valuation and Dilution Errors

Don’t optimize for the highest valuation at each round. Focus on finding investors who add value beyond capital and leave room for future funding rounds without excessive dilution.

The reality is that a lower valuation with the right investor often leads to better long-term outcomes than a higher valuation with passive capital.

Investor Mismatch

Taking money from investors who don’t understand your business or have misaligned expectations creates problems that persist throughout your relationship. Be selective about investor fit, not just check size.

Building Your Funding Strategy

Your funding strategy should align with your business model, growth timeline, and long-term objectives. Consider these factors when planning your approach:

Capital Efficiency

CPG companies can often achieve profitability with less capital than tech startups, but they need more working capital for inventory and slower cash conversion cycles. Plan your funding strategy around these realities.

Exit Strategy Alignment

Different funding sources have different exit expectations. Understand whether your investors expect an IPO, acquisition, or dividend returns, and ensure these align with your own objectives.

Your funding strategy isn’t just about raising capital – it’s about building a sustainable business that creates value for all stakeholders. The most successful CPG companies view funding as a strategic tool rather than just a financial necessity.

At Beast Creative Agency, we’ve seen how the right funding strategy, combined with effective marketing and brand positioning, accelerates CPG growth beyond what either element could achieve alone. Our AI-enhanced campaigns help funded CPG brands maximize their marketing ROI while building the transparent, data-driven relationships that investors value. Ready to align your funding success with marketing excellence? Let’s discuss how our certified specialists can amplify your growth trajectory.