Consumer packaged goods companies burn through $1.2 trillion in working capital annually, yet most don’t realize they’re sitting on a goldmine of untapped cash flow opportunities. The difference between CPG winners and strugglers often comes down to how smartly they manage the money tied up in their operations.

Understanding CPG Working Capital Fundamentals

Working capital management in the CPG industry isn’t just about keeping the lights on—it’s about creating a competitive advantage through smart cash flow optimization. Unlike service businesses, CPG companies deal with complex inventory cycles, seasonal demand fluctuations, and multiple distribution channels that can either boost or drain cash flow.

Here’s the thing: your working capital consists of three main components that directly impact your cash position. Current assets (inventory, accounts receivable, cash) minus current liabilities (accounts payable, short-term debt, accrued expenses) equals your working capital. But in the CPG world, this simple equation becomes complicated fast.

The CPG Cash Flow Challenge

CPG businesses face unique working capital pressures that other industries don’t encounter. You’re dealing with:

- Long product development cycles that tie up cash before revenue starts flowing

- Seasonal inventory buildups that can strain cash flow for months

- Retailer payment terms that often extend 60-90 days

- Raw material price volatility that affects procurement timing

- Product lifecycle management requiring constant SKU optimization

The reality is that many CPG companies operate with working capital cycles of 120+ days, meaning cash invested in operations takes four months to return. That’s a massive opportunity cost if not managed properly.

Inventory Optimization Strategies

Inventory typically represents 60-80% of working capital in CPG companies, making it your biggest lever for cash flow improvement. Smart inventory management starts with understanding your true demand patterns, not just what your sales forecasts predict.

Demand Forecasting Accuracy

Most businesses miss this: improving forecast accuracy by just 10% can reduce inventory holding costs by 15-20%. Here’s what works:

- Use point-of-sale data from retailers instead of relying solely on shipment data

- Factor in promotional lift patterns and competitor actions

- Segment forecasts by channel, region, and customer type

- Build in seasonality adjustments based on multi-year trends

You’ll want to move beyond simple moving averages toward more sophisticated forecasting models that account for external factors affecting demand. Weather patterns, economic indicators, and even social media sentiment can improve forecast accuracy when properly weighted.

SKU Rationalization

Here’s what many CPG companies don’t realize: the 80/20 rule often understates the problem. In reality, you might find that 90% of your profit comes from 30% of your SKUs. The remaining 70% are cash flow drains disguised as revenue generators.

Start by analyzing each SKU’s contribution to gross profit, not just revenue. Factor in the true cost of complexity—additional production runs, quality testing, inventory carrying costs, and obsolescence risk. You might discover that eliminating low-performing SKUs frees up working capital while actually improving profitability.

Accounts Receivable Management

CPG companies often struggle with accounts receivable because they’re dealing with large retail customers who have significant negotiating power. But there are strategies to optimize cash collection without damaging customer relationships.

Payment Terms Optimization

This might surprise you: many CPG companies accept standard payment terms without negotiating. Even small improvements can have massive cash flow impacts when you’re dealing with large order volumes.

Consider these approaches:

- Offer 2/10 net 30 terms (2% discount for payment within 10 days)

- Negotiate shorter terms for new product launches or promotional periods

- Use dynamic discounting programs that offer sliding scale discounts for early payment

- Set up automatic payment systems with key accounts

Credit Management

Don’t just focus on getting paid faster—focus on getting paid, period. CPG companies face unique credit risks, especially when dealing with smaller retailers or entering new markets.

Set up credit monitoring systems that track payment patterns and flag potential problems early. A customer who starts paying in 45 days instead of 30 might be showing early signs of financial stress. Catching these trends early gives you options beyond writing off bad debt.

Accounts Payable Optimization

Here’s where many CPG companies leave money on the table. Your payables aren’t just bills to pay—they’re a source of free financing when managed strategically.

Supplier Payment Strategy

The goal isn’t to pay bills as late as possible (that damages relationships), but to optimize payment timing for maximum cash flow benefit while maintaining strong supplier relationships.

Start by categorizing suppliers based on their importance to your operations and their payment flexibility. Strategic suppliers might get paid early in exchange for better terms or priority treatment. Commodity suppliers might be paid on standard terms to maximize your cash float.

Early Payment Discounts

Most businesses evaluate early payment discounts incorrectly. A 2% discount for paying in 10 days instead of 30 isn’t just 2%—it’s equivalent to a 36% annual return on your cash. That’s usually better than any other investment you could make.

But here’s the catch: only take early payment discounts if you have excess cash or access to cheaper financing. Paying suppliers early while carrying expensive debt defeats the purpose.

Seasonal Cash Flow Management

CPG companies face predictable seasonal patterns that create working capital challenges. The key is planning for these cycles instead of reacting to them.

Seasonal Inventory Planning

Start building your seasonal inventory plan 6-9 months in advance. This gives you time to negotiate better terms with suppliers, secure financing if needed, and optimize production schedules.

Consider these strategies:

- Use vendor financing programs to spread inventory costs over time

- Negotiate consignment arrangements for slow-moving seasonal items

- Build strategic inventory buffers for your fastest-turning products

- Plan promotional activities to move seasonal inventory before it becomes obsolete

Financing Seasonal Working Capital

You’ll need financing to bridge seasonal cash flow gaps, but not all financing is created equal. Revolving credit lines tied to inventory or receivables often provide the most cost-effective solution for seasonal needs.

Asset-based lending can provide more financing capacity than traditional term loans because it’s secured by your working capital assets. As your inventory and receivables grow seasonally, your available credit grows with them.

Technology Solutions for Working Capital Management

The reality is that manual working capital management doesn’t scale in today’s CPG environment. You need systems that provide real-time visibility into cash flow and automate routine decisions.

Cash Flow Forecasting Tools

Modern cash flow forecasting goes beyond simple spreadsheets. Look for solutions that integrate with your ERP system and provide rolling 13-week forecasts with scenario modeling capabilities.

Key features to prioritize:

- Real-time integration with accounting and inventory systems

- Automated variance analysis and exception reporting

- Scenario modeling for different demand and payment assumptions

- Mobile access for decision-makers who aren’t always at their desks

Inventory Management Systems

Your inventory management system should do more than track quantities—it should optimize working capital deployment across your entire product portfolio.

Look for systems that calculate optimal order quantities based on carrying costs, stockout costs, and cash flow impact. The goal is finding the sweet spot between having enough inventory to meet demand while minimizing cash tied up in slow-moving stock.

Key Performance Indicators for CPG Working Capital

You can’t manage what you don’t measure. Here are the essential KPIs every CPG company should track for working capital optimization:

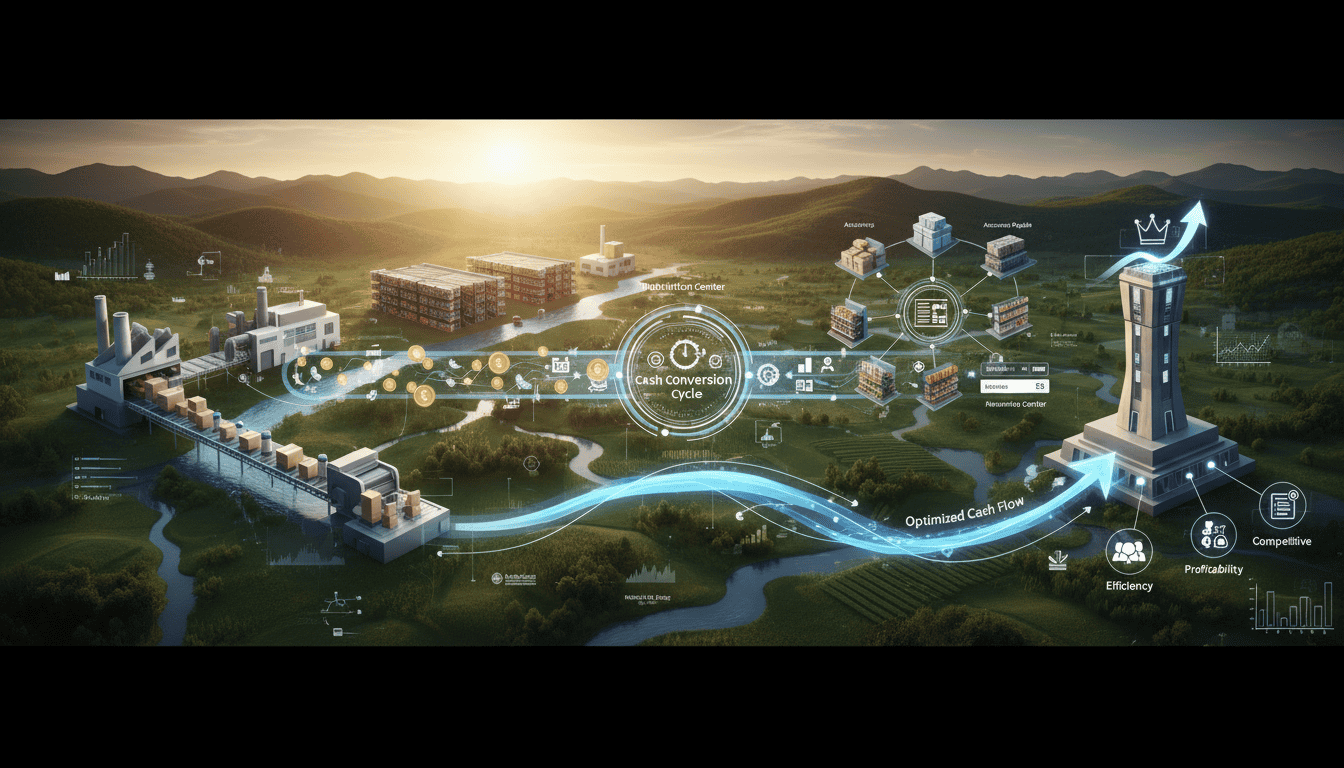

Cash Conversion Cycle

This measures how long it takes to convert inventory investment into cash from sales. Calculate it as: Days Sales Outstanding + Days Inventory Outstanding – Days Payable Outstanding.

Industry benchmarks vary, but most successful CPG companies target cash conversion cycles of 60-90 days. If yours is significantly longer, you’ve got work to do.

Working Capital Turnover

This ratio shows how efficiently you’re using working capital to generate revenue. Calculate it as: Annual Revenue / Average Working Capital.

Higher ratios indicate more efficient working capital use, but be careful not to optimize this metric at the expense of customer service or growth opportunities.

Inventory Turnover by Category

Don’t just calculate overall inventory turnover—break it down by product category, channel, and seasonality pattern. This granular view helps you spot opportunities for improvement that overall metrics might hide.

Risk Management in Working Capital Optimization

Here’s what many companies get wrong: they optimize working capital without considering the risks they’re introducing. Cutting inventory too aggressively can lead to stockouts. Extending payment terms too far can damage supplier relationships.

Balancing Efficiency and Risk

The goal isn’t to minimize working capital—it’s to optimize it. Sometimes carrying extra inventory of critical components makes sense if supplier lead times are unreliable. Sometimes offering better payment terms to key suppliers secures priority treatment during shortages.

Build buffer stocks for your most profitable products and fastest-growing categories. Cut aggressively on slow-moving, low-margin items. This balanced approach protects revenue while freeing up cash.

Stress Testing Your Working Capital

Run scenario analyses to understand how your working capital responds to different conditions. What happens if demand drops 20%? What if your biggest customer extends payment terms by 15 days? What if raw material costs spike 30%?

These stress tests help you build contingency plans and identify potential cash flow pressure points before they become problems.

Building a Working Capital Optimization Culture

Successful working capital management isn’t just about systems and processes—it’s about creating a culture where everyone understands their impact on cash flow.

Cross-Functional Collaboration

Your sales team’s decisions about payment terms affect cash flow. Your purchasing team’s decisions about order quantities tie up working capital. Your marketing team’s promotional plans drive inventory needs.

Create regular working capital review meetings that include representatives from sales, marketing, operations, and finance. Share cash flow forecasts and discuss how different decisions affect the company’s liquidity position.

Incentive Alignment

Consider incorporating working capital metrics into management incentive plans. If your sales team is only measured on revenue, they have no incentive to negotiate better payment terms. If your purchasing team is only measured on cost savings, they might not consider the working capital impact of order timing.

Balanced scorecards that include cash flow metrics help ensure everyone is pulling in the same direction.

Conclusion

Working capital optimization in the CPG industry requires a systematic approach that balances cash flow efficiency with operational effectiveness. Companies that excel at this create sustainable competitive advantages through better cash flow, stronger supplier relationships, and more strategic inventory deployment.

The key is starting with accurate data, building robust forecasting capabilities, and creating organizational alignment around cash flow objectives. Remember, working capital optimization isn’t a one-time project—it’s an ongoing process that adapts to changing market conditions and business priorities.

At Beast Creative Agency, we understand that effective working capital management often requires clear communication with stakeholders, from suppliers to customers to internal teams. Our marketing expertise helps CPG companies build stronger relationships that support better payment terms, more flexible supplier arrangements, and clearer internal alignment around cash flow objectives. Ready to optimize your working capital story? Let’s talk about how strategic communication can support your financial goals.